Seasonal Employees Ppp Loan Forgiveness

Expenses eligible for forgiveness are those that are incurred over the 8 to 24 week period starting from the day you receive your PPP loan from your lender. For seasonal employers that may benefit from the alternative criteria for computing payroll cost of seasonal employees the borrower should immediately contact their lender to request they hold off.

Ppp Loan Forgiveness Everything You Need To Know Bnc Tax

You do not need to adjust your payroll schedule.

Seasonal employees ppp loan forgiveness. This Interim Final Rule addresses the needs of certain potential borrowers that are seasonal employers by allowing. Their loans would be substantially more than the self-employed solopreneurs 20833. Click here to read our overview of whats new and what hasnt changed.

Under Treasurys interim final rule issued on April 24 2020 seasonal employers including restaurants lodging establishments tourism companies and guiding operations can now choose any consecutive 12-week base payroll period between May 1 and Sept. When applying for PPP loan forgiveness be prepared to provide documentation that proves you did your due diligence in hiring new people to restore your pre-coronavirus pandemic headcount. For each individual employee the total amount of cash compensation eligible for forgiveness may not exceed an annual salary of 100000 as prorated for the Covered Period.

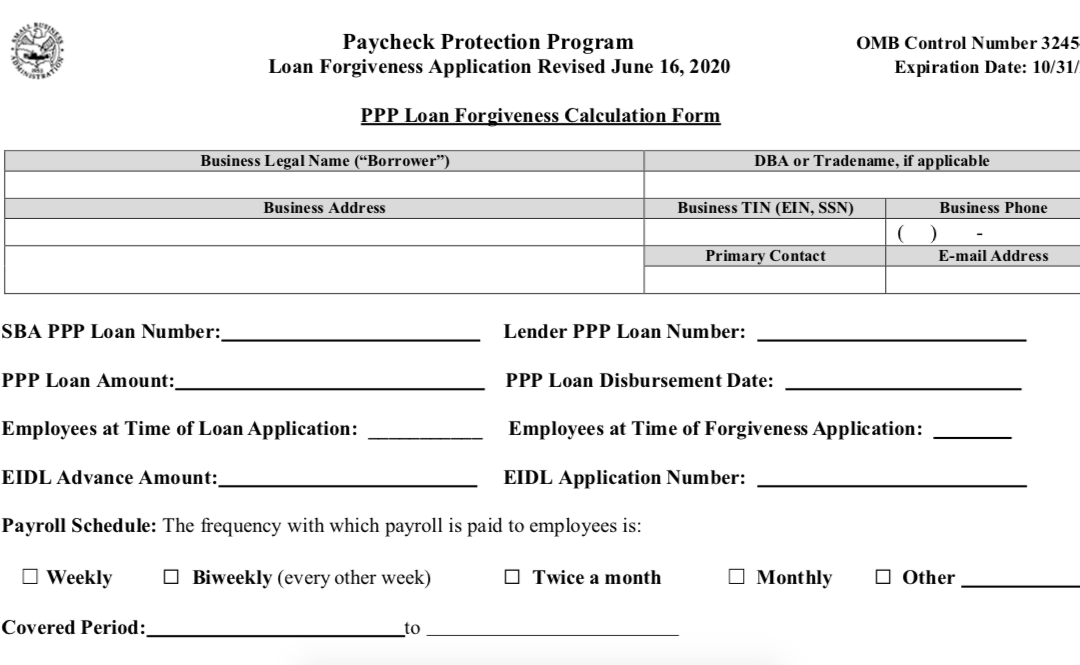

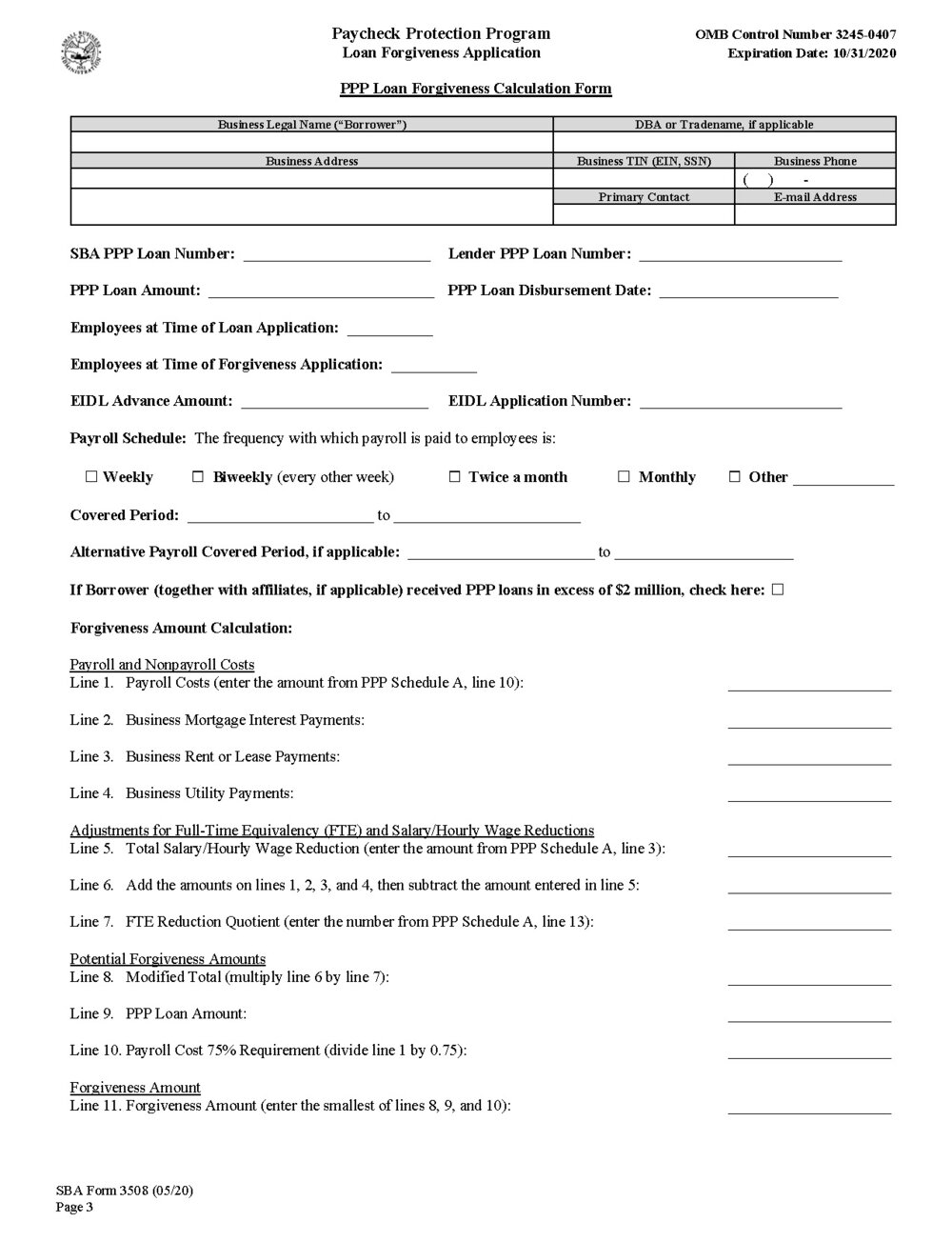

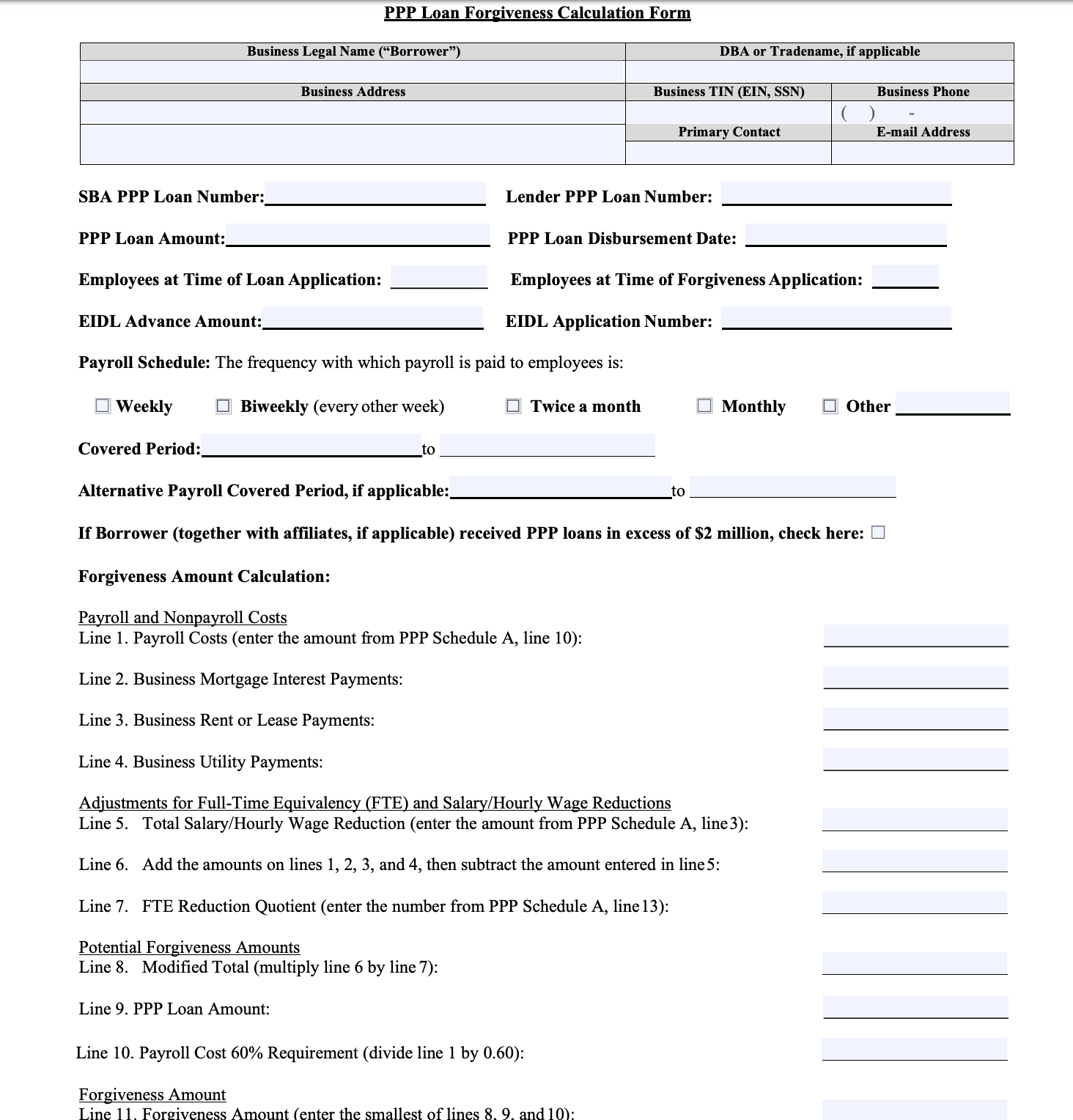

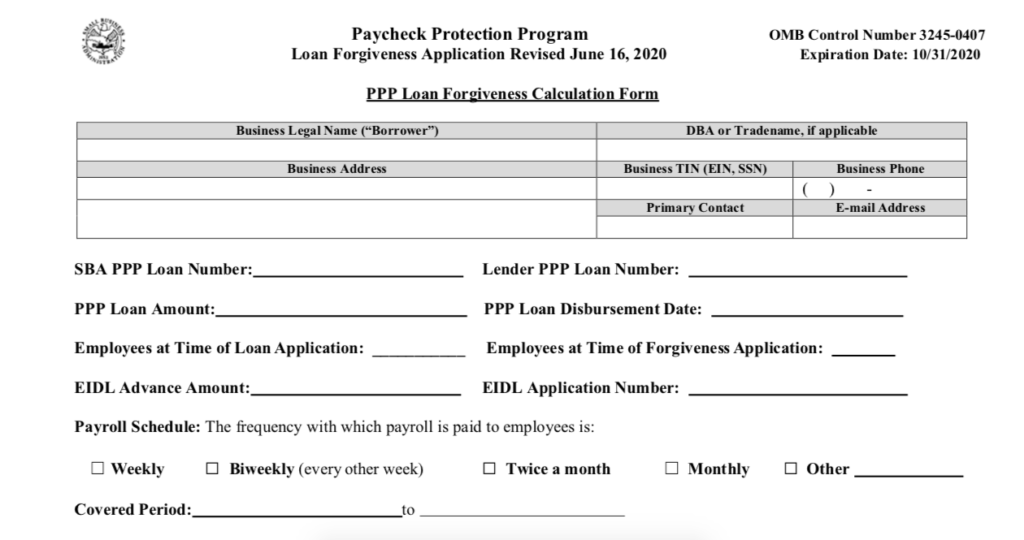

As a threshold matter there is no doubt that temporary employees count toward the 500 employee limit for general PPP eligibility. This is not necessarily the date on which you signed your loan agreement. Apply for loan forgiveness To apply for PPP loan forgiveness use the SBAs Loan Forgiveness Application form Form 3508 or your lenders equivalent form.

In early 2021 SBA released new forgiveness forms and rules for first- and second-draw PPP loans. The answer is a resounding maybe. Loans over 50000 loan forgiveness may be impacted by reductions in the number of your employees and reductions in employee wages.

A seasonal employer that elects to use a 12-week period between May 1 2019 and September 15 2019 to calculate its maximum PPP loan amount must use the same 12-week period as. On April 27 2020 Treasury issued an interim final rule allowing seasonal borrowers to use an alternative base period for purposes of calculating the loan amount for which they are eligible under the PPP. After completing the form and attaching any necessary documents submit it to your lender.

A recurring question about Paycheck Protection Program PPP loans is whether compensation paid to temporary employees qualify as forgivable payroll costs. Under section 1102 of the CARES Act a seasonal employer may determine its maximum loan amount for purposes of the PPP by reference to the employer average total monthly payments for payroll the 12-week period beginning February 15 2019 or at the election of the eligible borrower March 1 2019 and ending June 30 2019. Loan proceeds must be spent during the 8- to 24-week period immediately following.

For purposes of loan forgiveness however the borrower will have to document the proceeds used for payroll costs in order to determine the amount of forgiveness. Small Business Administration SBA posted a fifth Interim Final Rule on Additional Criterion for Seasonal Employees. 68 percent of all self-employed loan.

Hold Filing to Address Seasonal Payroll Computations. So you would use this form if your PPP loan amount was 150000 or less. SBA Issues New Rule for PPP Loans to Seasonal Employers.

Who can apply for a First Draw PPP loan for 2021. Otherwise you may run into issues qualifying for loan forgivenessand your total forgivable amount may be reduced. On April 27 2020 the US.

PPP loan forgiveness. You might be able to use Form 3508EZ or Form 3508S if you meet the eligibility guidelines. Recent guidance on eligible costs owner compensation forgiveness reductions and more.

Businesses that are eligible to apply for the PPP loan must have 500 or fewer employees or meet the SBAs alternative size standard. For an 8-week Covered Period that total is capped at 15385 per employee. For purposes of the 500-employee threshold all employees.

In that case they would have applied for a PPP loan that covered their employee payroll as well. For a 24-week Covered Period that total is capped at 46154 per employee.

Applying For Ppp Loan Forgiveness Lincoln Savings Bank Lsb Financial Banking Insurance Investments Trust And Mortgage Services For Iowa

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Ppp Loan Forgiveness Reduction When Employee Declines To Return To Work Tonneson Co

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

Sba Paycheck Protection Program For Businesses First United

Everything You Need To Know About Ppp Loans In 2021 Funding Circle

Ppp For Self Employed How To Calculate Ppp Loan Amount Using Gross Income Youtube

Are You Eligible For Ppp Loan Forgiveness Market Business News

Ppp Loan Forgiveness Application How To Calculate Fte S Updated Template Youtube

Ppp Loan Forgiveness Application Instructions Released By The Sba And Treasury Department Whitinger Company

Updated Ppp Loan Forgiveness Guidance From Sba Stein Sperling

Ppp Loan Forgiveness Faqs Tatsuguchi Cpa

Paycheck Protection Program Loan Forgiveness Becu

Ppp Loan Forgiveness Requirements How To Apply Divvy

How To Fill Out Your Ppp Forgiveness Application Form Simplifi Payroll And Hr

New Ppp Loan Rules Make More Money Available To Artists And Other One Person Businesses Cerf

Are You Eligible For Ppp Loan Forgiveness Market Business News

Ppp Loan Forgiveness Everything You Need To Know Bnc Tax

Understanding Ppp Loan Forgiveness Application And Instructions

Post a Comment for "Seasonal Employees Ppp Loan Forgiveness"